ABSOLUTE ASCENDANCY

BUILD STRENGTH - ELIMINATE WEAKNESS - UNLEASH POTENTIAL

Mastermind – How to Avoid Scams

Commencing operation . . .

Overview

As soon as the coronavirus lockdown was instigated, several financial scams were unleashed to the public, and consequently, many have lost large sums of money unexpectedly.

Disaster gives rise to opportunity.

Unfortunately, some people would exploit such opportunities for malicious ends. With the sudden upheaval that has taken place across the globe, the economic recession that we are currently facing and the three-week extension of the UK lockdown, now more than ever do we need to be careful to avoid getting caught in such scams.

Understandably, individuals will want to find means to make their money work harder during these adverse times, but carelessness will lead to financial ruin. Therefore I list ten simple steps that you can follow to help safeguard yourself from scams. I am also going to run through a worked example and talk through my personal experience.

How to Avoid Scams

- Do Your Research

- Guilty Until Innocent

- Get a Second Opinion

- Too Good to be True

- Damage Limitation

- Haste Makes Waste

- Abstain from Unusual Requests

- Avoid Clicking anything Suspicious

- Keep Your Details Secure

- Trust Your Instinct

1. Do Your Research

The first step you need to do before you consider investing your money with a company is to conduct a background check on them. You want to ensure that the company is legitimate and that they have positive reviews. You should also familiarise yourself with their cancellation policy in terms of how straightforward it is for you to get your money back.

2. Guilty until Innocent

I would recommend the mind-set of ‘Guilty until Innocent’ to help keep you out of trouble while attempting to further your finances. By which I mean, do your research as mentioned above, and if you should find even a single piece of evidence that would suggest a scam, SLAM DOWN THE HAMMER OF JUSTICE, and look elsewhere.

Remember, you hold power here. It is your money you are looking to invest, and there are thousands of different investment/trading companies out there for you to choose from. Therefore spend the time to make sure you pick a reputable company rather than one that could be dubious.

3. Get a Second Opinion

People think in many different ways, so a second opinion can shed light on an angle you may have overlooked. It should not hurt to double-check with someone reliable before you invest your hard-earned money, to help ensure that you do not lose it all!

4. Too Good to be True

I am sure you have heard of the saying, “if it is too good to be true, it is!” A common strategy used by scammers is to present people with a “magic Christmas land” scenario that will solve their most pressing problems.

The harsh reality is that such solutions practically do not exist. There is no shortcut to the top. You have to grind and put in the hours. Those who seek the easy way out are likely to find only disappointment in the end.

5. Damage Limitation

A way to limit potential losses is to invest only a small amount of cash initially. Once you are confident that the trader is legitimate, you can then look to increase your investment. Also, if you have a dedicated separate account with funds you wish to use for investing, this could limit the overall amount of money you lose should things go wrong.

6. Haste Makes Waste

A tactic that scammers and salespeople like to use is to put pressure (usually time-bound) on people to make them act quickly and, therefore, irrationally. Eagerness and fear are emotions that can get the best of us and make the worst of us. If you ever feel pressured into doing something, you need to take a step back and think things through from a place of balance before taking any action.

7. Abstain from Unusual Requests

Having an awareness that scams do exist is an excellent first line of defence. Common sense should prevail in these situations, but we all have moments of weakness.

If anyone you do not know or trust asks for your card details, account information, money, steer clear! If they want to install a program onto your machine, request to remotely access your device or anything else that could be perceived as unusual, DO NOT DO IT!

8. Avoid Clicking anything Suspicious

Text messages, links in emails, and pop ups from your browser. All of these are potential lures to install viruses onto your machines, which can then collect your personal information and transfer them to the scammers. Use a third party independent source of information if you need to verify any data sent to you through dubious sources, rather than using any contact information provided through their communications with you.

9. Keep Your Details Secure

Avoid storing your passwords online, and use different, complex ones for each site. Restrict the number of personal details you share on social media, or better yet get rid of it entirely. Avoid working in public areas with shared Wi-Fi. Check your bank statements regularly to make sure no suspicious payments are being made.

Be careful with your online identity as well as your offline, as these days, both are equally important. It can be a simple task for an online hacker to create a fake account using only information gathered about you online.

10. Trust Your Instinct

If something does not feel right, then get away! Even the average human should possess enough instinct to know when something feels off. If you have honed your intuitive abilities through rigorous training and critical thinking, then all the better. The point is, your gut instinct should very rarely lead you astray, so trust in it.

A Worked Example

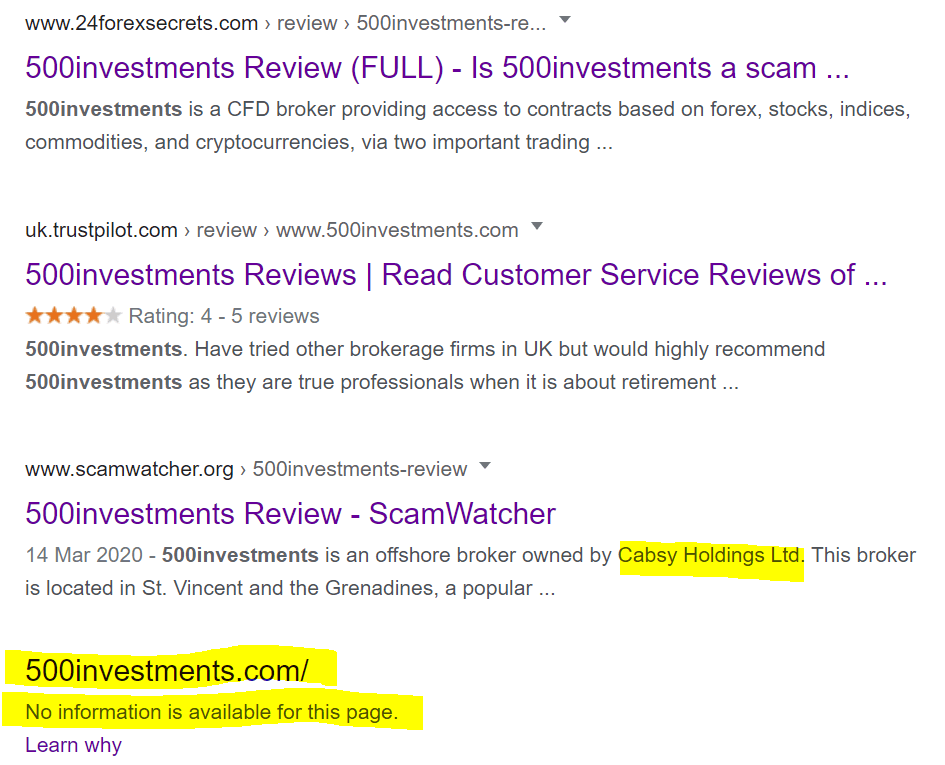

Okay, so I thought it would be good to work through an example so you can see some of the suggestions above in action. The scam in question is a trading company called 500investments. I searched and found these results on the first page.

I checked a couple of reviews, and there are mixed opinions on the legitimacy of the company. The ‘Guilty until Innocent’ methodology has shown a red flag, so at this point, I would not consider investing with the company. However, let’s continue the investigation for educational purposes.

If you look at the highlighted website right at the bottom, you can see that there is no information available for the web page to their site. This is highly suspicious as any reputable company would include an excerpt to provide some basic information about who they are and what they do.

I then searched for Cabsy Holdings Ltd and found ABSOLUTELY NO INFORMATION ABOUT THEM. Now while I admit I cannot say with 100% certainty that 500investments is a scam, the analysis above is more than enough for me to justify not investing with them.

My Experience

Yes, I have been scammed in the past. Like I said earlier, it can happen to the best of us. It only takes a single moment of weakness, and a fleeting lapse of poor judgement to make a critical error. I know well the immense frustration that comes from being played for a fool and getting robbed. I made a mistake many years back, almost a decade ago, but through that blunder, I have learned the hard and painful way to be extremely careful concerning scammers.

Conclusion

I have written this article so that you can take on board the advice and hopefully not become a victim of fraud. In the event that something does go wrong, cancel the card you used for payment and notify your bank or the authorities immediately.

Mission complete – Overlord Drakow signing out.